Running a small business means wearing a lot of hats, and keeping your accounts in order is one job that can easily slip down the list.

If you’re self-employed, having a bank account that connects directly to your accounting software can save hours of admin and help you stay on top of your finances without the usual stress.

This is where modern digital banks like Tide and Zempler come into their own.

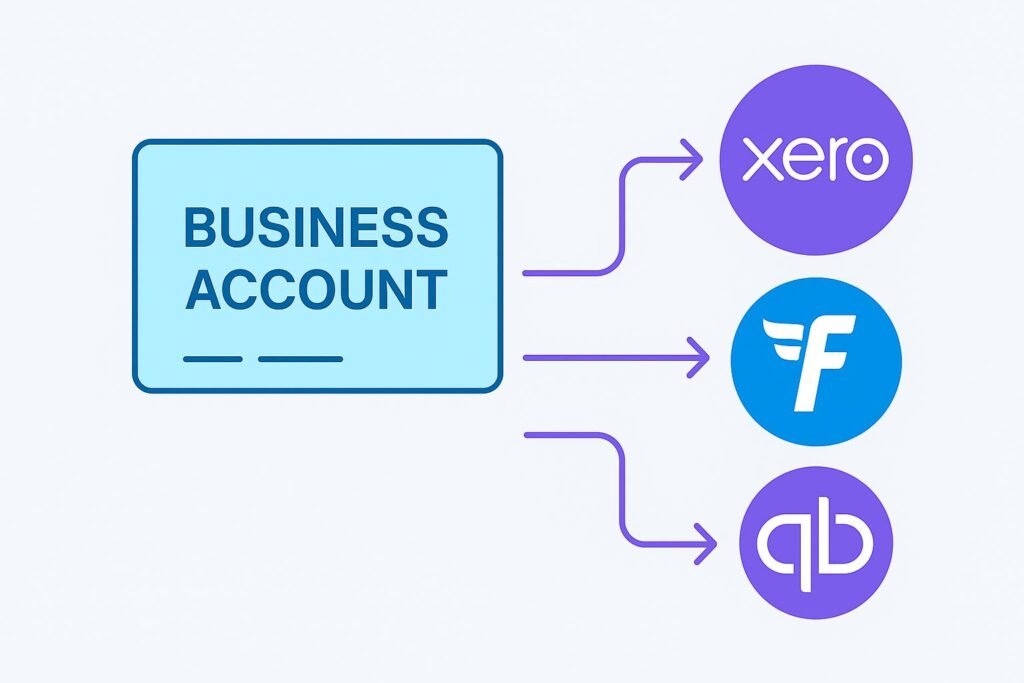

Not only do they offer business accounts tailored to sole traders and freelancers, but they also integrate seamlessly with popular accounting platforms like Xero, FreeAgent and QuickBooks – making day-to-day finances much easier to manage.

1. Live bank feeds mean less manual input

At the heart of these integrations is something called a live bank feed. This lets your bank account talk directly to your accounting software, sending through a daily stream of transactions without you having to upload CSVs or type anything manually.

Here’s how Tide and Zempler work with the top UK tools:

- Xero: Secure Open Banking link, updating transactions multiple times per day. You can reconcile payments, split expenses, and generate real-time cashflow reports.

- FreeAgent: Perfect for sole traders. Both Tide and Zempler appear on FreeAgent’s supported bank list and connect via a simple login authorisation.

- QuickBooks: Bank feeds pull in income and expenses directly, allowing quick tagging and categorisation. Ideal for VAT-registered traders working under MTD rules.

Once connected, you won’t need to chase missing transactions or worry about forgetting to include a purchase – everything syncs automatically in the background.

2. Match invoices and payments automatically

If you use your accounting software to send invoices, Tide and Zempler can help you track when those payments come in. As money lands in your account, it’s matched to the correct invoice – no guesswork needed.

This means fewer overdue payments slipping through the cracks, and less time spent chasing clients who’ve already paid.

3. Easy setup – even for the non-technical

You don’t need to be an accountant to get things running. Most connections take just a few clicks:

- Open your accounting software and go to bank feeds

- Select Tide or Zempler from the list of providers

- Log in securely to approve the connection

- Choose which account(s) to link

After that, transactions begin flowing in automatically, and you can start reconciling your books in real time.

4. Built-in tools that support better bookkeeping

Both Tide and Zempler offer useful features that support your bookkeeping without needing full software:

- Tide includes invoice generation, expense labelling, and instant payment alerts. You can also set up automatic expense categories to speed up your workflow.

- Zempler offers transaction tagging and a clean dashboard that’s ideal for keeping personal and business costs separate. Handy for budgeting and year-end planning.

While you’ll still want full accounting software for filing tax returns and VAT, these extras make it easier to stay organised day to day.

5. A future-proof solution for Making Tax Digital

With MTD for Income Tax on the horizon (from April 2026 for most sole traders earning over £50,000), it’s becoming more important to have a digital bookkeeping setup in place.

Both Tide and Zempler already comply with Open Banking standards, and their integrations with Xero, FreeAgent and QuickBooks help ensure your records are up to scratch when the rules tighten.

Quarterly submissions, digital record-keeping, and seamless HMRC filing will soon become the norm. Having a smart bank account that integrates with your accounting software now will save you hassle later.

Read our expert guide to MTD here.

Final thoughts

If you’re self-employed and want to spend less time on admin, linking your bank account to your accounting software is a smart move. Tide and Zempler are both designed with modern sole traders in mind, and their integration with platforms like Xero and FreeAgent makes them ideal partners for managing your books.

Looking for the right accounting platform to go with your new bank account? Take a look at our guide to the best software for the self-employed.